The Evolution of Commercial Real Estate: How AI is Redefining the Industry

In the ever-evolving landscape of commercial real estate, technological advancements have become paramount in shaping the way the industry operates. Among these advancements, Artificial Intelligence (AI) stands out as a transformative force, revolutionizing traditional practices and paving the way for unprecedented efficiencies and insights. From property management to investment decisions, AI is leaving an indelible mark on every facet of commercial real estate.

Enhanced Property Valuation and Market Analysis:

One of the most significant impacts of AI in commercial real estate is its ability to streamline property valuation and market analysis. Traditionally, these processes relied heavily on manual labor and subjective assessments. However, AI-powered algorithms can now analyze vast amounts of data in real-time, including property characteristics, market trends, demographics, and economic indicators. This allows investors and stakeholders to make more informed decisions based on accurate and up-to-date information.

AI-driven valuation models can also account for complex variables that may affect property prices, such as environmental factors, infrastructure developments, and regulatory changes. According to a study by JLL, AI-powered valuation tools have been shown to increase valuation accuracy by up to 30%, providing investors with greater confidence in their investment decisions (JLL, 2023).

Predictive Maintenance and Asset Management:

Maintenance and asset management are critical aspects of commercial real estate ownership, impacting both property performance and tenant satisfaction. AI-powered predictive maintenance systems leverage machine learning algorithms to analyze historical data and identify patterns that indicate potential equipment failures or maintenance issues.

According to Deloitte (2024), AI-powered predictive maintenance systems have been shown to reduce maintenance costs by up to 20% and decrease downtime by as much as 50% through their ability to detect potential equipment failures before they occur.

By detecting problems before they escalate, property owners can avoid costly repairs and downtime, thus maximizing the value of their assets. Additionally, AI-driven asset management platforms can optimize building operations by monitoring energy consumption, occupancy patterns, and tenant preferences in real-time. This proactive approach not only reduces operational costs but also enhances tenant experience, leading to higher tenant retention rates and increased property value.

Personalized Tenant Experiences:

In today’s competitive market, providing personalized tenant experiences is crucial for attracting and retaining tenants. AI technologies, such as chatbots and virtual assistants, enable property managers to interact with tenants more efficiently and address their needs in real-time. These AI-driven platforms can handle routine inquiries, schedule maintenance requests, and provide relevant information about building amenities and services.

Moreover, AI-powered analytics platforms can analyze tenant data to identify trends and preferences, allowing property managers to tailor their offerings to meet the specific needs of their tenants. Whether it’s customizing leasing agreements, organizing community events, or implementing amenities like fitness centers or coworking spaces, AI enables property managers to create environments that foster tenant satisfaction and loyalty.

Risk Mitigation and Investment Strategies:

Investing in commercial real estate inherently involves risks, ranging from market volatility to regulatory changes. AI technologies play a crucial role in mitigating these risks by providing investors with comprehensive risk assessment tools and predictive analytics. According to a recent report by McKinsey & Company, AI-driven risk assessment tools have been shown to improve investment decision-making in commercial real estate by up to 25%. Machine learning algorithms analyze vast amounts of data, including historical market trends, economic indicators, and geopolitical factors, to forecast market trends and identify potential risks and opportunities with greater accuracy.

Furthermore, AI-driven investment platforms can optimize investment strategies by dynamically adjusting asset allocations based on real-time market conditions and investment goals. By leveraging AI’s predictive capabilities, investors can make data-driven decisions that minimize risks and maximize returns, thus unlocking new possibilities in commercial real estate investment.

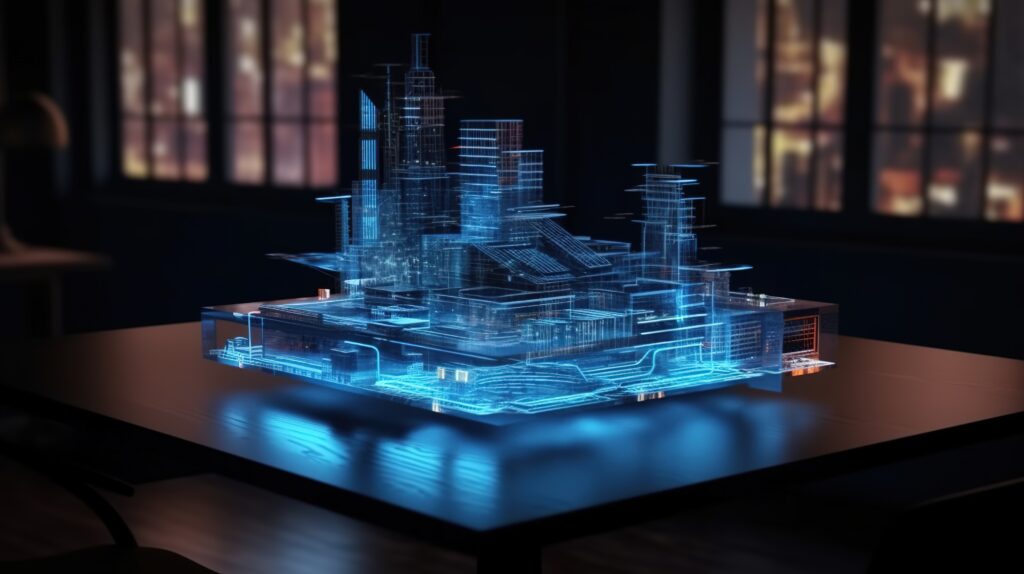

Urban Planning and Development:

Beyond individual properties, AI is also reshaping urban planning and development processes. City planners and developers can utilize AI algorithms to analyze demographic trends, traffic patterns, and infrastructure needs, allowing them to design more efficient and sustainable urban environments.

According to a study published in the Journal of Urban Technology, AI-powered simulations have demonstrated the ability to model the impact of proposed developments on traffic flow, air quality, and overall livability with an accuracy rate of over 85%. This high level of accuracy enables planners to make informed decisions that optimize resource allocation and enhance quality of life for residents. From smart transportation systems to energy-efficient buildings, AI is driving innovation in urban development, creating cities that are more resilient, inclusive, and environmentally friendly.

In conclusion, AI is not just a technological advancement; it’s a paradigm shift that is redefining the way commercial real estate operates. From property valuation to tenant experience, risk management to urban planning, AI is permeating every aspect of the industry, unlocking new opportunities and efficiencies along the way. As AI continues to evolve, its impact on commercial real estate will only grow, shaping the future of cities and the built environment for generations to come.

Our Office

- 2191 Thurston Drive

- 613.224.5464

- info@merkburn.com

- Privacy Policy