A Comprehensive Guide to Selling Your Industrial Property in Canada

Selling industrial property in Canada can be a complex and multifaceted process. Whether you’re a seasoned real estate professional or a first-time seller, understanding the intricacies of the Canadian industrial real estate market is crucial to maximizing your return on investment. In this comprehensive guide, we will delve into the key steps, considerations, and strategies you need to successfully sell your industrial property in Canada.

Market Research:

Before embarking on the journey to sell your industrial property, it’s vital to conduct thorough market research. The Canadian industrial real estate market is diverse, with variations in demand and pricing depending on the region. Begin by researching the specific market conditions in your area, taking note of trends, vacancy rates, and the overall health of the industrial real estate market. Local real estate boards, government publications, and industry reports can provide valuable insights into the current market dynamics.

Property Valuation:

By contrast, a commercial space used for an office will generally have lower foot traffic, the parking will not generally exceed the number of workers as it would with retail real estate, there is usually lower visibility and moderate accessibility, and the price per square foot is lower than it might be for a retail store. Office spaces are commonly used for businesses in the technology, accounting, insurance, legal, real estate, medical field or others.

However, one of the most critical aspects of setting the right price is to strike a balance between competitiveness and profitability. This balancing act is a bit like determining the worth of a rare collectible; it’s not just about what it’s worth but also about finding the right buyer who recognizes its value.

For sellers in Ottawa, Ontario, The Ottawa Real Estate Board advises setting a competitive yet realistic asking price. Overpricing your property can lead to extended listing times, which may become a burden, and, ironically, may ultimately result in lower offers. Buyers are savvy, and they’ll likely wait for a price reduction. On the flip side, underpricing your property may seem like a quick sell, but it could mean leaving money on the table. A competitive price, on the other hand, attracts potential buyers and can lead to a quicker, more profitable sale.

Property Preparation and Presentation

First impressions matter when selling industrial property. The physical condition of your property, its aesthetic appeal, and its functionality can significantly impact its marketability. Here are some key aspects to consider:

Repairs and Maintenance: Address any necessary repairs and maintenance issues to ensure your property is in its best condition. This can include fixing plumbing, electrical, or structural issues and repainting where needed.

Cleanliness and Organization: A clean, well-organized property is more appealing to potential buyers. Clear out the clutter, ensure all areas are tidy, and maintain the landscape.

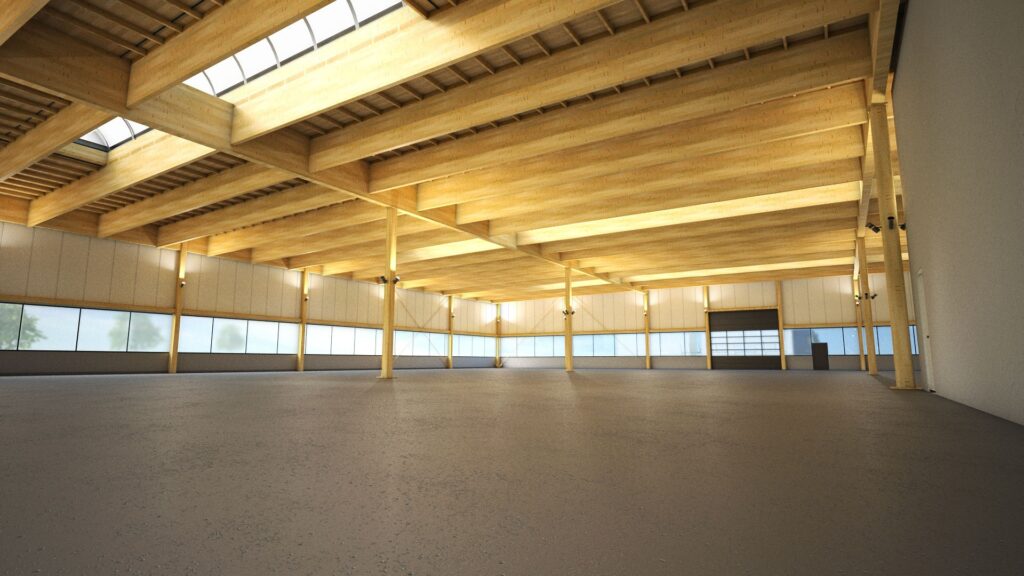

Staging: Consider staging the property to help potential buyers visualize its potential. This can be particularly effective for vacant industrial spaces.

Environmental Compliance: Ensure your property is in compliance with all relevant environmental regulations and safety standards.

Documentation: Gather and organize all essential property documents, including zoning information, permits, maintenance records, and financial statements.

Marketing and Promotion

To attract potential buyers, you must implement a robust marketing strategy. In today’s digital age, online platforms play a significant role in the marketing of industrial properties. Here are some strategies to consider:

Real Estate Listings: Partner with a reputable real estate agent or brokerage firm that specializes in industrial properties. They will list your property on industry-specific platforms, such as LoopNet or Realtor.ca, and market it to their network of potential buyers.

Professional Photography and Videography: High-quality photographs and virtual tours can showcase your property in its best light and capture the attention of prospective buyers.

Social Media: Utilize social media platforms like LinkedIn, Twitter (X), and Facebook to promote your property. Targeted advertising can help reach a broader audience.

Networking: Attend industry events, conferences, and local business gatherings to connect with potential buyers and investors.

Traditional Marketing: Consider traditional marketing methods, such as print advertising in industry publications or newspapers, to reach a broader audience.

Negotiation and Closing

Once you’ve attracted interested parties and received offers, the negotiation process begins. Negotiating the terms of the sale, including the price, closing date, and contingencies, can be complex. It’s essential to work closely with a skilled real estate lawyer and agent to ensure the terms align with your goals.

Throughout the negotiation process, be prepared to counteroffer and make concessions as needed to reach an agreement. Once an agreement is reached, the transaction moves into the closing phase, which includes due diligence, inspections, finalizing legal documents, and completion of the sale.

Legal and Financial Considerations:

Selling industrial property is not just about marketing and negotiations; it involves meticulous attention to legal and financial aspects. In Ottawa, Ontario, where the rules and regulations may vary slightly from other regions, these considerations become paramount. Here are the key points to keep in mind:

Legal Counsel: When navigating the intricacies of selling your industrial property, it’s essential to engage a qualified real estate attorney with local expertise. This legal expert will take the helm in handling crucial aspects of the transaction, including the drafting and review of contracts, conducting thorough title searches, and helping to resolve any potential disputes.

Financing and Mortgages: Ensure that any existing mortgages or liens on the property are addressed during the sale. This may involve paying off existing loans or negotiating with lenders.

Tax Implications: The tax landscape can be complex when selling industrial property. Consult with a local tax professional who understands the tax consequences of the sale. This includes assessing capital gains tax and other tax obligations, which can vary depending on the specific nature of the property.

Closing Costs: The City of Ottawa is situated in the Province of Ontario which, as with any region, has its own set of closing costs to consider. Be prepared for various expenses, which may include legal fees, land transfer tax, real estate commissions, title insurance, and other transaction-related costs.

Selling industrial property in Ottawa, Ontario, Canada requires careful planning, market research, and a thorough understanding of the legal and financial aspects involved. By following this comprehensive guide, you can better navigate the complexities of the Ottawa industrial real estate market with confidence. From initial market research to the final closing, each step is essential to ensure a successful and profitable transaction. Seek the assistance of professionals when needed, stay informed about market trends, and approach the sale of your industrial property with a well-thought-out strategy to maximize your return on investment.

Our Office

- 2191 Thurston Drive

- 613.224.5464

- info@merkburn.com

- Privacy Policy